Merger & Acquisitions

According to Harvard Business Review 70% to 90% of the M&A deals don’t deliver the expected value and according to McKinsey >70%.

The focus of most deal teams is often almost solely on financials and transactional requirements but sometimes lack the focus on company cultures and talent. Many deals don’t fail because of the wrong strategic rationale but because of a clash in company cultures or poor execution of the integration from a people perspective.

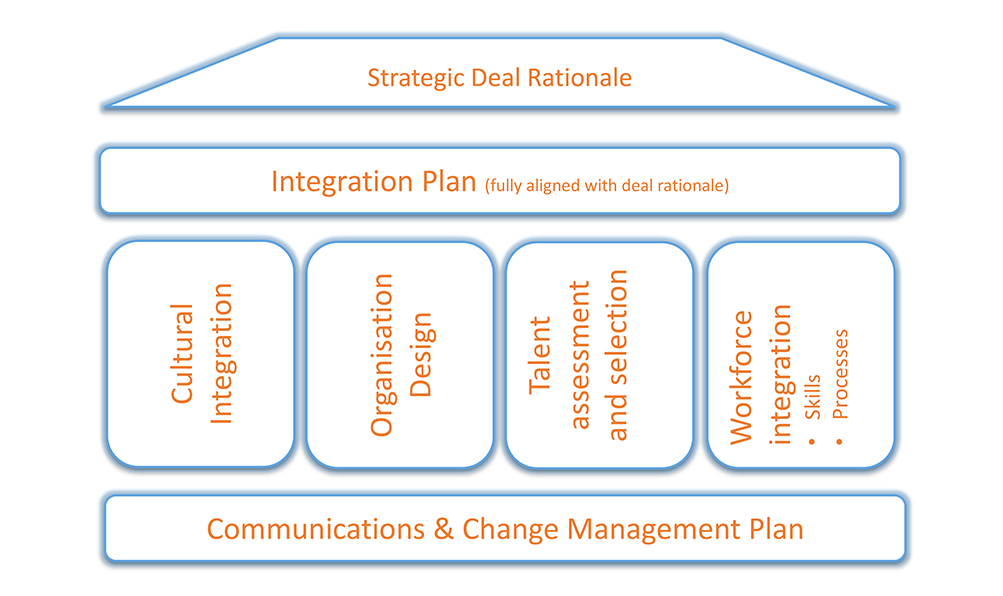

A lack of quality in the integration is often the result of poor integration planning. For most businesses the critical success factors for a good integration are a well delivered culture, people and process integration. And that needs careful, early and good planning shaping the structure of the deal and first class implementation.

The investment for a good people and integration planning during due diligence will pay off during integration and will increase the chance of success to deliver the expected value creation expressed in the deal rationale.

Our experienced team can support you through all stages of an M&A deal in regards to People, HR and Organizational Design aspects. We will work together with you on looking at the core people elements shaping the design of the deal and the implementation.